Statement on interest rates

The decision follows a comprehensive review of our funding costs, in light of the Reserve Bank’s 0.25 per cent cut to the overnight cash rate.

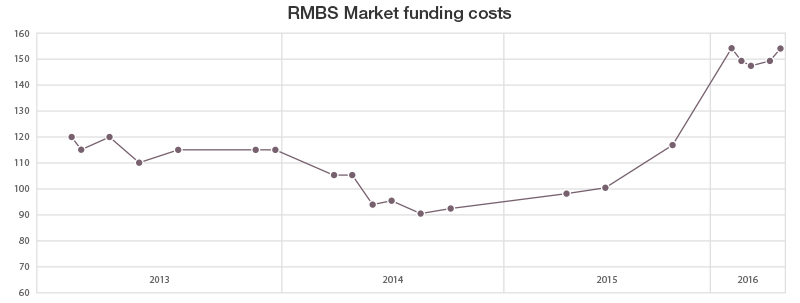

It also considers an offsetting rise in costs for us to raise money in the Residential Mortgage Backed Securities (RMBS) market, from which we ultimately draw our funding.

As can be seen in the graph below, funding costs in this market have risen since late 2015, despite cuts by the RBA to the overnight cash rate.

For Firstmac and other lenders, this is placing additional costs pressure on our portfolio.

We believe the 0.13 per cent cut - which is above the industry average - strikes a fair balance, maintaining our position as a non-bank lender with competitive rates.

Firstmac continues to provide strong competition to the banks, ensuring that Australian borrowers have access to good value home loans.

Media contact: Rhys Ryan at email rhysr@mgrco.com.au or call 0427 227 719