An investment in Firstmac High Livez ARSN 147 322 923 (Fund) entails risk, the following is a non-exhaustive summary of some of the risks applying to an investment in the Fund. Prior to making an investment in the Fund you should carefully read the product disclosure statement and consider obtaining professional financial advice.

Auto ABS RiskMarket risk Auto ABS is a type of Asset-Backed Security that is secured by automobile consumer and commercial loans. Similar to RMBS risk (above) whether principal and interest is paid on an ABS note partly depends on whether the underlying borrowers default on the loans.

Capital riskThe repayment of capital is not guaranteed. Consequently, you could lose some or all of your money invested in the Fund.

Credit riskThis risk relates to the Fund's exposure to movements in credit risk ratings of issuers of the fund's assets. Credit risk ratings are an assessment of an issuer's ability to meet its financial obligations. If credit risk ratings change, this may reduce the value of the Fund's assets which may in turn reduce the overall value of the Fund.

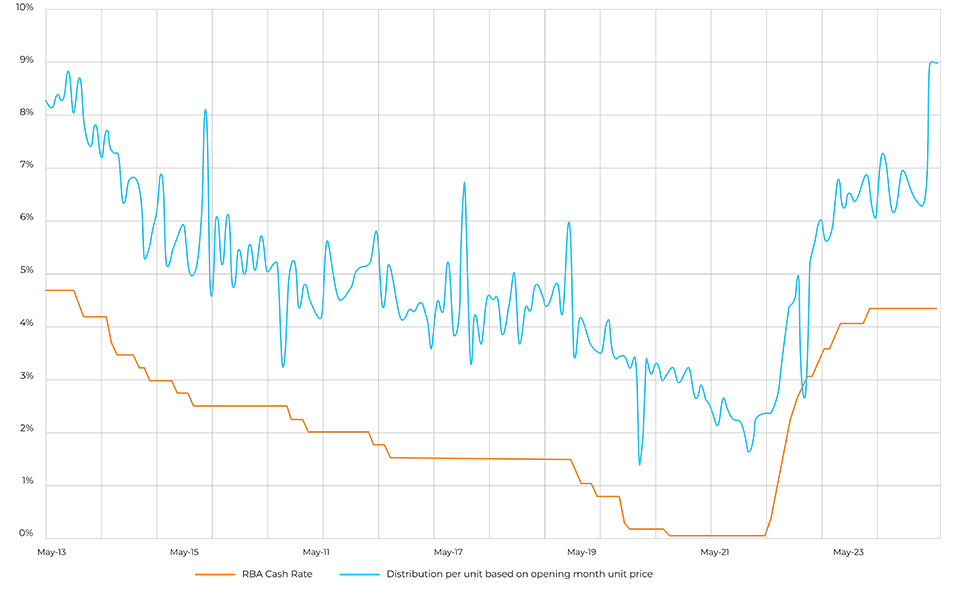

Interest rate riskThe risk that the capital value or income of an investment may be adversely affected when interest rates rise or fall. In particular, the income of a RMBS can fluctuate significantly in reaction to changes in interest rates. RMBS transactions are typically floating rate in nature paying a fixed margin over BBSW. Reductions in BBSW will result in a lower income. The capital value of RMBS can fluctuate significantly in reaction to changes in fixed margins available in the market.

Market riskGenerally, the investment return on a particular asset is correlated to the return on other assets from the same market, region or asset class. Market risk is impacted by broad factors such as interest rates, political environment, investor sentiment and certain events may have a negative effect on the price of all types of investments within a particular market. These events may include changes in economic, social, technological or political conditions, as well as market sentiment, the causes of which may include changes in governments or government policies, political unrest, wars, terrorism, pandemics and natural, nuclear and environmental disasters. The duration and potential impacts of such events can be highly unpredictable, which may give rise to increased and/or prolonged market volatility.

RMBS riskRMBS is a type of Asset-Backed Security that is secured by a pool of residential mortgages. Whether principal and interest is paid on an RMBS note partly depends on whether the underlying borrowers default on the loans held by the RMBS trust. If the underlying borrower does default on their loan, the following steps will usually occur:

- Possession taken of the residential property,

- Sale of the residential property RMBS risk

- Any shortfall is submitted as a claim to mortgage insurers If mortgage insurers

- If mortgage insurers are unable to pay the claim (for example deteriorated financial capacity arising from extreme adverse financial conditions) then the shortfall would be absorbed by the net interest margin of the RMBS trust

- If the net interest margin is insufficient then the cash reserve, if any, would be used to meet the shortfall

- If the cash reserve is insufficient then the principal of the lowest Class notes is reduced

- If the lowest Class note is insufficient then the principal of the lowest Class notes is reduced

- If that Class note is insufficient then the principal of the next lowest Class note is reduced and so on. The highest Class notes will have a lower interest rate because of their security position at the top of the principal and interest priority order. The lower Class notes will have a higher interest rate because of their security position in the principal and interest priority order.