-

About Us

With over $15 billion of loans under management, people place their trust in Firstmac

Find Out MoreAbout FirstmacWho we are and how we can help you achieve your goals.

Our HistoryOur journey from a small family business to a big family business!

-

Our Purpose

Helping people at the heart of everything we do

Our PurposeESG FootprintOur Environmental, Social and Governance footprints.

Domestic Violence PolicyOur Environmental, Social and Governance policies.

Women, Children and Community ProgramSupporting Women, Children & Community.

Broncos SponsorshipLong-term sponsors of the mighty Brisbane Broncos NRL team.

Our ValuesThe core values that guide us every day.

-

Our People

We are real people, not robots or a faceless corporation

Our PeopleFirstmac cultureOur positive and inclusive work environment.

RecruitmentInterested in joining the Firstmac team?

Executive TeamThe key people who run our company.

Board of DirectorsIntroducing the Firstmac Board.

-

Products

We specialise in simple, affordable and competitive financial products.

Our ProductsHome LoansLooking for low-rate home loan with great features?

Asset FinanceOur simple asset finance loans will get you behind the wheel fast.

High Livez InvestmentOur investment fund backed by Aussie home and car loans.

Term DepositsConvenient and competitive term deposits.

CalculatorsHome and car-loan calculators and more…

FAQsGot a question about our products?

- Contact Us

-

Login

Firstmac Money

Login to online services and manage your account.

Firstmac onTrackLogin and access your loan documents electronically.

Home Loan BrokersSite with tools and resources for home loan brokers.

Car Loan BrokersSite with tools and resources for car loan brokers.

ManagersSite with tools and resources for mortgage managers.

Institutional InvestorsPortfolio data for Firstmac RMBS and ABS.

Who we are and how we can help you achieve your goals.

Our HistoryOur journey from a small family business to a big family business!

NewsroomOur latest innovations, stories and public announcements.

AwardsSee how the experts have recognised Firstmac.

Our Environmental, Social and Governance footprints.

Domestic Violence PolicyOur Environmental, Social and Governance policies.

Women, Children and Community ProgramSupporting Women, Children & Community.

Broncos SponsorshipLong-term sponsors of the mighty Brisbane Broncos NRL team.

Our ValuesThe core values that guide us every day.

Our positive and inclusive work environment.

RecruitmentInterested in joining the Firstmac team?

Executive TeamThe key people who run our company.

Board of DirectorsIntroducing the Firstmac Board.

Looking for low-rate home loan with great features?

Asset FinanceOur simple asset finance loans will get you behind the wheel fast.

High Livez InvestmentOur investment fund backed by Aussie home and car loans.

Term DepositsConvenient and competitive term deposits.

CalculatorsHome and car-loan calculators and more…

FAQsGot a question about our products?

Login to online services and manage your account.

Firstmac onTrackLogin and access your loan documents electronically.

Home Loan BrokersSite with tools and resources for home loan brokers.

Car Loan BrokersSite with tools and resources for car loan brokers.

ManagersSite with tools and resources for mortgage managers.

Institutional InvestorsPortfolio data for Firstmac RMBS and ABS.

A fund backed by everyday Australian Home and Car Loans

Fund performance

Data Table - High Livez Performance

| Annual performance (% per annum) | Distribution Return | Growth Return | Total Return* |

|---|---|---|---|

| Current Month Annualised | 6.98% | 0.48% | 7.46% |

| 1 year | 6.67% | 1.42% | 8.10% |

| 3 year | 4.29% | 0.07% | 4.35% |

| 5 year | 3.98% | 0.14% | 4.12% |

| 10 year | 4.36% | 0.04% | 4.40% |

| Since inception# | 4.93% | 0.40% | 5.33% |

Past performance is not indicative of future performance

# inception date was 29 March 2011

Performance Summary

Fund Objective

The Trust aims to provide stable monthly income returns from a diversified portfolio of Asset-Backed Securities supplemented by a small allocation towards Short Term Money Market Securities.

The Trust will invest in Asset-Backed Securities and Short Term Money Market Securities which are normally only available to professional and institutional investors.

Our Investment Committee is pleased with the results of our fund, delivering on our objectives of capital stability and regular monthly income. We also maintain and manage liquidity closely across our fund should Unit Holders choose to redeem at any month end.

Fund Update

During February, the Fund Unit Price increased from 1.0486 to 1.0536, the highest Unit Price in two years. The increase was due to strong demand in credit markets for the underlying bond instruments in which our fund invests. The momentum is broad spread across most credit markets. Separate from the High Livez fund, and as an example of buoyant markets, Firstmac issued a non-bank record RMBS issuance size of $2.0Billion during February. The senior AAA Notes on this transaction priced at BBSW1month +1.20%.

Unit Price volatility has remained low within a very narrow band. This is consistent with the fund objective of providing stable monthly income for our unit holders.

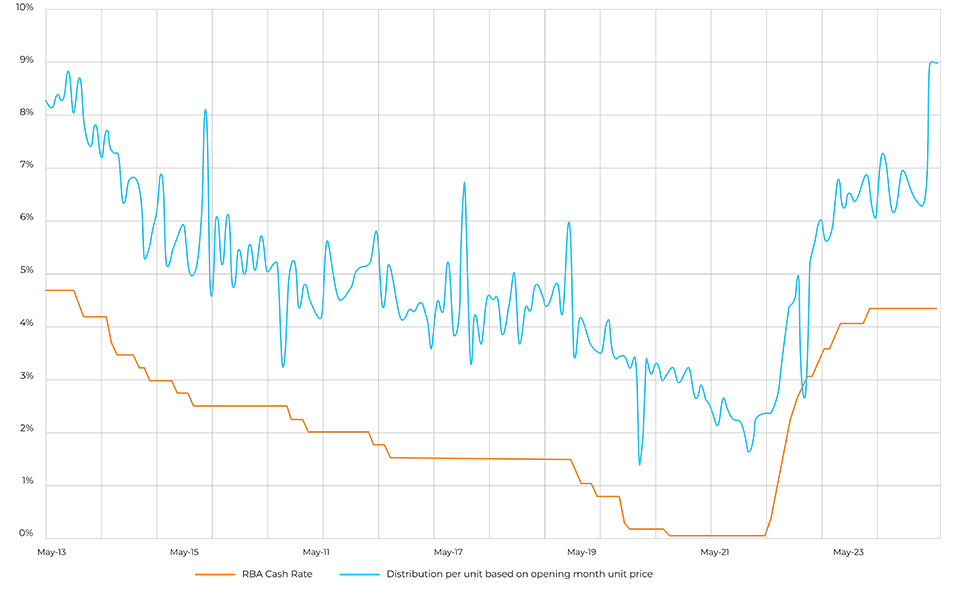

The fund has experienced low Unit Price volatility of an annualised 1% (calculated since August 2012). This means that the movement in Unit Price is quite narrow, tracking closely to the mean. This is consistent with a low risk managed fund.For the month of February 2024, our fund distributed an annualised 6.98%, representing a margin above the RBA cash rate of 2.63%.

The RBA has now lifted the cash rate target thirteen times for a total of 4.25%. This has resulted in a corresponding increase in the one month bank bill rate off which our fund investments reset above. The investments of the fund are all floating rate Notes which reset monthly. Hence, a rising cash rate will result in higher coupon receipts, increasing the distribution return of the fund. This means that increased collections, and therefore distributions, are anticipated in the future, continuing the trend illustrated in the above chart.

The RBA Cash rate and BBSW1m are 99.4% correlated over a ten year period. The RBA cash rate is widely understood and provides a useful explanation of fund returns, i.e. demonstrating that the fund returns are heavily influenced by changes in the RBA cash rate, as of course BBSW1m is highly correlated with the RBA cash rate.

Underlying asset quality remains strong, with low delinquencies across the underlying residential mortgages. We are pleased with our portfolio resilience however we do anticipate some increase in delinquencies associated with increasing mortgage rates. We expect all investments to be comfortably within tolerance over the months ahead.

The Total Return for the past 10 years was 4.40% per annum.

It is recommended that unitholders invest with a timeframe of 3-5 years. Over the past year three years, the Total Return was 4.35% per year, and over the past five years was 4.12% per annum.

The High Livez Fund is not capital guaranteed.

Australian Economic Update

Australian economic indicators released in February again showed mostly soft economic readings. January retail sales rose 1.1% m-o-m, but after falling a revised 2.1% in December. Housing indicators weakened in December with the value of home loans down 5.6% m-o-m and home building approvals down by 9.5% m-o-m. Employment rose by only 500 in January and the unemployment rate rose to a two-year high 4.1% from 3.9% in December. The January CPI showed annual inflation at 3.4% y-o-y, unchanged from December. The RBA’s interest rate setting committee left the cash rate unchanged at 4.35% at its early-February meeting and indicated that wage growth above 4% y-o-y (the Q4 wage price index was up 4.2% y-o-y) and weak productivity growth would delay any opportunity to start cutting the cash rate.

Australian Credit Markets

Markets continued its rally over February as markets saw Global Inflation decline further whilst supported by a robust US corporate reporting season. Australian risk assets mirrored the positivity seen in other global markets, with the Australian iTraxx tighter by 5 basis points to close at 63 basis points, noting that these levels are the tightest seen over the 2023 / 2024. Physical credit assets performed well with significant issuances across Corporates, Bank senior and Tier 2 and Structured. The strength of the domestic Tier 2 market was demonstrated in the Macquarie 10NC5 Tier 2 transaction which had over A$4.97bn of interest for an A$1.25bn transaction (largest ever demand for Tier 2 transaction), the demand saw pricing move in 20 basis points from initial guidance (same levels as previous NAB and ANZ transactions earlier in the month). Post pricing, the transaction performed well in the secondary market driven by investors seeking to increase allocation to the transaction. February continued January’s momentum in A$ securitsation markets with another extremely busy month across both primary and secondary. Primary structured issuance saw the highest post GFC monthly volumed issued at A$9.33bn across ten deals with a further 3 transactions mandated. Investor demand remains strong for these deals with tranches being preplaced and or having note oversubscription across the capital stack.

Historical performance assumptions

*Total Return for the 10 years to 29 February 2024 and 5.33% since inception on 29 March 2011. The total return is the Fund’s consolidated performance over the period referenced. Performance is calculated on an initial investment of $10,000 with distributions reinvested. Ongoing fees and expenses have been applied however individual taxes are excluded. This website is prepared and issued by Firstmac Limited ACN 094 145 963 (Firstmac) the holder of Australian financial services licence (AFSL) number 290600 in respect of Firstmac High Livez ARSN 147 322 923 (Fund). Perpetual Trust Services Limited ACN 000 142 049, the holder of AFSL number 236648 is the responsible entity (RE) and the issuer of the units in the Fund (Units). A target market determination for the Fund is available at www.firstmac.com.au or by contacting Firstmac on 13 12 20. This website has been prepared without taking account of your objectives, financial situation or needs. Before investing in the Fund, you should consider whether an investment in the Fund is appropriate having regards to your objectives, financial situation and needs and obtain appropriate professional advice. Prior to making a decision about whether to acquire, hold or dispose of Units you should consider the product disclosure statement (PDS) for the Fund available at www.firstmac.com.au. Past performance is not a reliable indicator of future performance and may not be repeated. Restrictions may apply to the amount and timing of withdrawal requests – refer to the PDS for full details.

Firstmac High Livez SQM Report 2021

SQM Research provides this report for use by financial advisers only. By accessing this report you warrant that you are a financial adviser or other similar investment professional.

Welcome to firstmac.com.au _

Just in case we lose you, may I ask for your contact details....

Loading Form